The Great Depression: Causes, Consequences, and Recovery

The Great Depression, a global economic crisis spanning from 1929 to 1939, stands as one of the most significant events in modern history. Its impact extended far beyond mere economic hardship; it profoundly reshaped global economies, political landscapes, and social structures. This essay will delve into the multifaceted causes of the Depression, analyze its devastating consequences, explore the arduous path to recovery, and examine its enduring legacy on the world stage.

I. The Descent into Depression: Unraveling the Causes

The Great Depression wasn’t a single event but a confluence of factors that interacted in a disastrous feedback loop. While the stock market crash of October 1929 is often cited as the trigger, it was merely the dramatic symptom of deeper, underlying issues:

A. Overproduction and Underconsumption: The roaring twenties witnessed unprecedented industrial growth in the United States. Mass production techniques fueled a boom in consumer goods, but wages failed to keep pace with this productivity surge. This created a disparity between the capacity to produce and the ability of consumers to purchase those goods. A surplus of unsold goods led to falling prices and reduced profits, ultimately hindering further investment and employment. This imbalance was exacerbated by unequal distribution of wealth, concentrating income in the hands of a small percentage of the population, leaving the vast majority with insufficient purchasing power to sustain the booming economy.

B. The Speculative Bubble and the Credit Crunch: The 1920s saw a surge in speculative investment, particularly in the stock market. Easy credit fueled a speculative bubble, with many individuals investing beyond their means, relying heavily on margin buying – borrowing money to purchase stocks. This artificially inflated the market, creating a highly vulnerable system. When the market finally corrected itself, the ensuing crash triggered a cascade of bankruptcies, wiping out billions of dollars in wealth and sending shockwaves through the financial system. The collapse of the credit market drastically reduced access to capital for businesses, which further hindered investment and economic activity. This credit crunch choked off the lifeblood of the economy, leading to widespread business failures and unemployment.

C. The Flaws in the Banking System: The US banking system lacked the robust regulation and oversight needed to prevent a financial meltdown. Numerous banks engaged in risky lending practices, investing heavily in the stock market and making speculative loans. The crash exposed the fragility of this system, leading to a wave of bank failures. As banks collapsed, depositors lost their savings, further eroding consumer confidence and hindering economic recovery. The lack of a central mechanism to provide liquidity to struggling banks exacerbated the crisis. This banking crisis compounded the impact of the stock market crash, transforming a financial crisis into a full-blown economic depression.

D. The Gold Standard and Deflationary Pressures: The adherence to the gold standard, a monetary system where currencies are pegged to a fixed quantity of gold, constrained government responses to the crisis. The gold standard limited the ability of central banks to increase the money supply and lower interest rates to stimulate the economy. The deflationary pressures resulting from the reduced money supply further aggravated the situation, making it harder for businesses to repay debts and for consumers to spend. This rigid monetary policy hampered efforts to counteract the economic downturn.

E. International Economic Interdependence and Protectionism: The global economy was already facing challenges before 1929, including war debts and uneven trade balances. The US’s high tariffs, enacted under the Smoot-Hawley Tariff Act of 1930, further exacerbated the situation by initiating a trade war, leading to reduced global trade and further contraction of the global economy. This protectionist approach, intended to shield domestic industries, had the unintended consequence of drastically reducing international trade, crippling economies already struggling to recover. This interconnectedness highlighted the vulnerability of the global economy to shocks originating in even one major nation.

F. Agricultural Depression: The agricultural sector had been experiencing difficulties for years before the crash, struggling with overproduction and falling prices. The Depression only amplified these problems, leading to widespread farm foreclosures and rural poverty. The decline in agricultural prices disproportionately impacted rural communities, which lacked the diversification of urban economies. This agricultural crisis further deepened the overall economic hardship across the nation.

II. The Scars of Depression: Devastating Consequences

The Great Depression’s consequences were catastrophic and far-reaching:

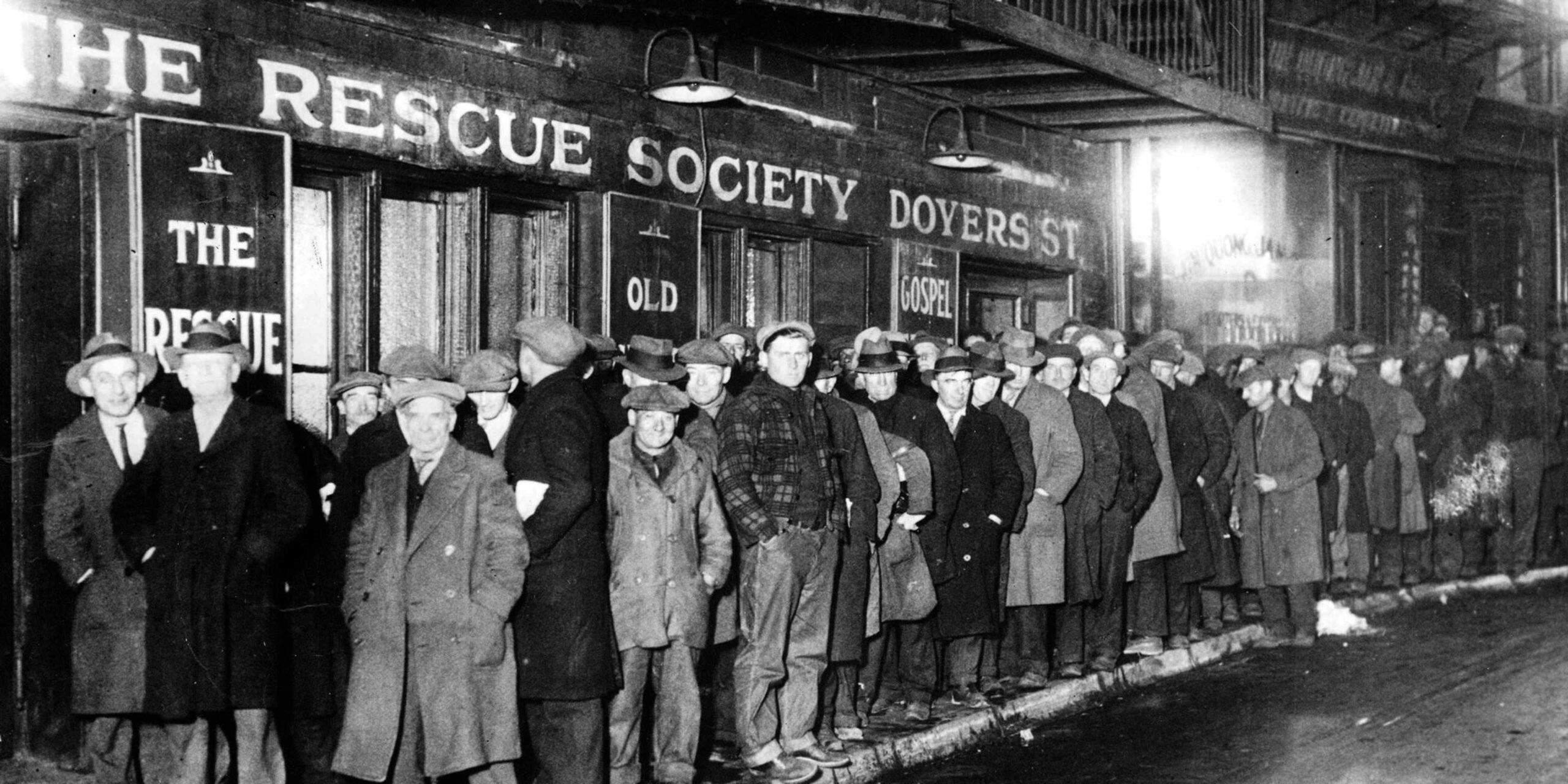

A. Mass Unemployment: Unemployment soared to unprecedented levels, exceeding 25% in the United States at its peak. Millions lost their jobs, leading to widespread poverty and social unrest. The psychological toll of unemployment was immense, leading to despair, hopelessness, and a breakdown of social cohesion. The lack of social safety nets left millions destitute and vulnerable.

B. Widespread Poverty and Homelessness: The economic collapse plunged millions into poverty. Families lost their homes, savings, and livelihoods. The resulting homelessness was widespread, with shantytowns, known as “Hoovervilles,” springing up across the country, a stark testament to the failure of the government’s response in the early years of the depression. These makeshift communities became breeding grounds for disease and desperation. Poverty led to malnutrition, increased illness, and a decline in overall health and well-being.

C. The Dust Bowl: Severe drought and dust storms in the Great Plains region compounded the economic hardship, devastating agriculture and displacing thousands of farmers. The Dust Bowl further exacerbated the plight of rural communities, forcing massive migration and contributing to the already staggering level of human suffering. The environmental catastrophe highlighted the interconnectedness of economic and ecological factors.

D. Social and Political Upheaval: The Depression fueled social unrest and political extremism. People lost faith in existing institutions and turned to alternative ideologies, including fascism and communism. The rise of extremist movements underscored the fragility of democratic systems in times of profound economic crisis. Social tensions increased, leading to conflicts between labor and management and increased social unrest.

E. Global Impact: The Depression was not confined to the United States; it spread rapidly across the globe, impacting all major economies. International trade plummeted, further deepening the crisis. The global nature of the crisis underscored the interconnectedness of the world economy and the need for international cooperation in addressing such calamities. Countries struggled to implement effective policies to alleviate the suffering of their populations.

F. Psychological Trauma: The collective psychological impact of the Great Depression was profound and long-lasting. The experience of widespread unemployment, poverty, and loss of security left a generation scarred, shaping their views on government, economic policies, and social welfare. The long-term psychological effects of the depression are still being studied today.

III. The Road to Recovery: Navigating the Path Out of Crisis

The recovery from the Great Depression was slow and uneven, a process marked by both government intervention and the gradual resurgence of private sector activity.

A. The New Deal in the United States: President Franklin D. Roosevelt’s New Deal program represented a significant shift in the role of the government in the economy. The New Deal implemented a series of programs aimed at providing relief to the unemployed, recovery of the economy, and reform of the financial system. These programs included the Civilian Conservation Corps (CCC), the Works Progress Administration (WPA), and the Social Security Act. The New Deal, while controversial, helped to alleviate some of the immediate suffering and laid the groundwork for a more robust social safety net.

B. Monetary and Fiscal Policies: Changes in monetary and fiscal policy played a crucial role in the eventual recovery. Expansionary monetary policies, such as lowering interest rates and increasing the money supply, helped to stimulate economic activity. Government spending on infrastructure projects and other public works programs also boosted demand and employment. The coordination of monetary and fiscal policies, though not always perfectly executed, was essential for the eventual stabilization of the economy.

C. The Role of World War II: While not a planned solution, World War II played a significant role in ending the Great Depression. The massive government spending on military production created jobs and stimulated economic growth, bringing many countries out of the economic doldrums. However, this recovery came at the enormous cost of global conflict and human lives. The war’s impact should be acknowledged as a factor, but not a desirable path to economic recovery.

IV. The Enduring Legacy: Lessons Learned and Lasting Impacts

The Great Depression left an indelible mark on the world, shaping economic policies and social attitudes for generations:

A. Increased Government Intervention: The Depression led to a greater acceptance of government intervention in the economy. The role of government in providing social safety nets and regulating the financial system expanded significantly, reflecting a shift from laissez-faire economics to a more interventionist approach. The New Deal era established precedents for government action in areas like unemployment insurance, social security, and financial regulation.

B. Keynesian Economics: The experience of the Great Depression spurred the development of Keynesian economics, a school of thought that emphasized the role of government spending in stabilizing the economy during recessions. Keynesian principles influenced economic policy for decades, advocating for government intervention to manage aggregate demand and prevent future depressions. This theoretical framework shaped government responses to economic downturns for decades.

C. International Cooperation: The Depression highlighted the need for international cooperation in managing economic crises. The establishment of international organizations like the International Monetary Fund (IMF) and the World Bank reflected a growing awareness of the global nature of economic problems. These institutions were designed to prevent future economic calamities through international coordination and assistance.

D. Financial Regulation: The banking crisis of the Great Depression led to significant reforms in the financial system, including the creation of deposit insurance schemes to protect depositors’ savings. These reforms aimed to strengthen the banking system and prevent future banking panics. This regulatory framework has undergone periodic revisions, reflecting ongoing efforts to mitigate systemic risks within the financial sector.

V. Conclusion:

The Great Depression was a watershed moment in history, leaving behind a legacy of economic and social change. While its immediate consequences were catastrophic, its long-term impact led to significant reforms and a greater understanding of the complexities of the global economy. The lessons learned from the Great Depression continue to inform economic policies and social programs today, emphasizing the importance of preventing future economic catastrophes through proactive regulatory measures and international cooperation. The memory of this period serves as a stark reminder of the devastating potential of economic crises and the importance of robust economic and social safety nets.